The industry has been of the belief in the past that as you get closer to retirement you need to protect your investment value at all cost, so you can maximise withdrawals that you wish to take in future.

We are now spending longer in retirement than ever before, so it seems logical to be cautious in order to give yourself the best chance of having enough in the bank to both enjoy yourself and take care of yourself.

Why are we so cautious as we approach this precipice of retiring, and turning on the income taps? The main reason is sequencing risk. Sequencing risk is the risk that a combination of income withdrawals and adverse investment returns might impact a portfolio’s ability to sustainably provide the required amount of income in subsequent years. Although the threat is at its peak when an investor begins to make withdrawals from their portfolio (as this is when the length of time over which income must be drawn is at its greatest), they also need to be mindful that it gradually increases from a number of years beforehand.

One way we can try and reduce sequencing risk is through diversification of asset classes, where a complementary approach of using fixed interest, equities, property and structured return can balance a portfolio so that if any periods of volatility is experienced, usually we have a ballast elsewhere in the portfolio to protect the value.

We believe this shouldn’t be changed as a client edges nearer to the decumulation phase of their portfolio, as one of the other risks to longevity within a portfolio is inflation. Fixed interest yields are not going to provide an attractive return for a client who may have a further 30 years of retirement ahead of them, so we need to find a way to structure a portfolio so they can still be comfortable taking an element of risk for the long term – as equities have consistently outperformed inflation.

Clik here to view.

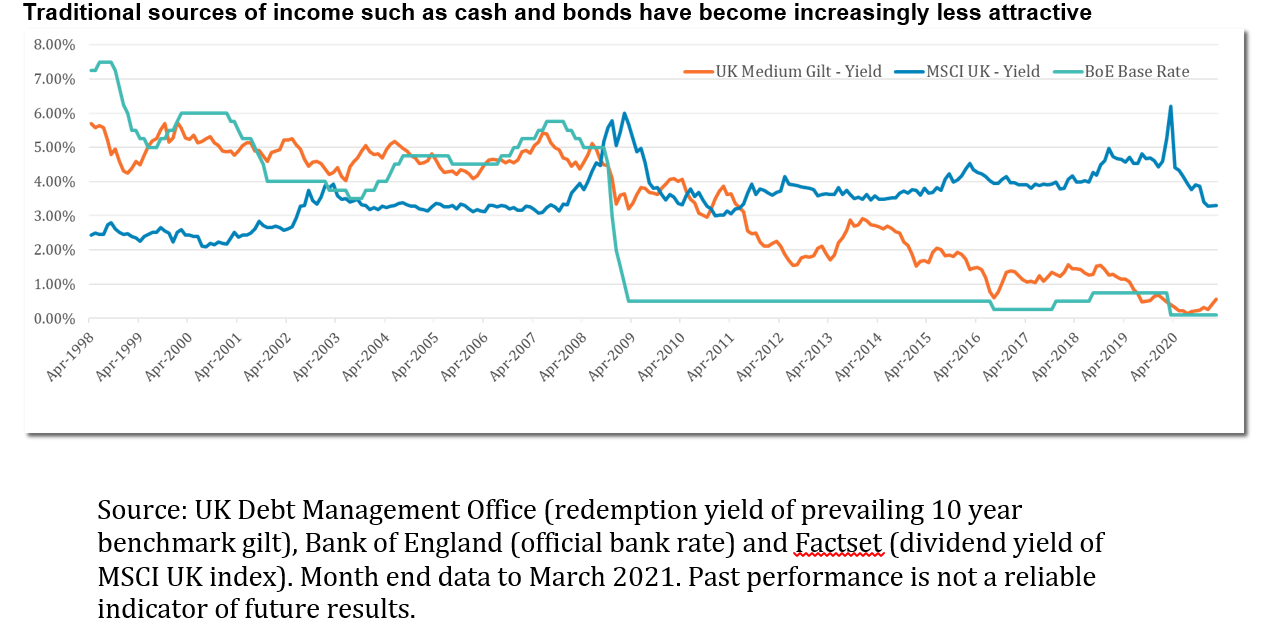

This chart shows the path of yields on traditional assets (cash, gilts, equities) over the last 20+ years. Following the financial crisis, yields on lower-risk assets have become increasingly less attractive, against a relatively healthy economic backdrop and low levels of volatility in risk markets.

This has forced investors, their financial intermediaries, and investment product providers to adjust their approach, particularly for clients who have income objectives and lower risk appetite. Over the last 10-15 years, appetite has increased for alternative assets such as infrastructure and structured products, and new and innovative investment solutions have come to market, from absolute return and risk-managed funds to bespoke discretionary fund management (DFM) services designed specifically for clients entering the decumulation phase.

At Brooks Macdonald, we use a two-portfolio structure, where a short-term portfolio is invested in defensive, defined return structured investments that provide income for the first seven years. As we near the time where income is needed, we would gradually invest into this short-term portfolio from a portfolio invested in growth assets such as equities for the long term. This allows us to reduce sequencing risk, as we would not need to withdraw funds from the growth portfolio at a time where it could potentially be experiencing market volatility.

As a bespoke DFM, we are able to gain access to structured return investments for our clients which have replaced a traditional fixed interest approach, providing our clients with a more attractive and defensive income stream for the short term. Being able to plan early and construct a tailored portfolio for our clients means that if any changes do arise, we are able to react accordingly, hopefully enabling our clients to look forward to the future, rather than worry about it.

Robin Eggar is head of UK investment management at Brooks Macdonald